South China methanol price trend analysis and forecast, June 2018

June 15, 2018

Shandong (JLC), June 15, 2018 –Methanol price in South China declined, with continuous arrival of imported goods.

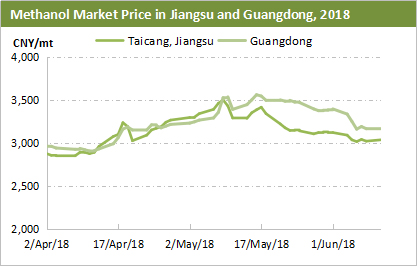

Against this backdrop, the price spread between Guangdong and Taicang narrowed to CNY 100-110/mt, which was CNY 230-240/mt narrower from H2, May, just as shown in the chart below.

Except for continuous arrival of imported goods, South China also suffered impacts from inflow of goods from East China ports, driven by the open arbitrage window from East China to South China as well as centralized MTO unit overhauls in East China in May.

According to JLC statistics, Guangdong received 68,000mt methanol goods from early June up to present, with 47% of these goods coming from East China or North China ports.

How will the methanol price in South China change in the following market? The following is the two key influencing factors.

On the one hand, the demand will be weak. June and July are two off-peak season for the traditional downstream demand industries of methanol.

Especially, South China methanol consumption relies on traditional downstream demand. Against the backdrop ofcentralized goods arrival but weakening downstream demand, downstream users mostly purchased on a need-to basis.

On the other hand, the methanol price in South China will enjoy support from firm offers in East China.The methanol price in East China will stay firm, amid limited arrival of imported goods, the expected unit restart in end June and the high international methanol offers. Thus, the firm methanol price in East China will support the methanol price in South China to some extent.

In short, the methanol price in South China will go range-bound in the short term.