Environmental protection inspection’s influences on methanol industry (Part 2)

July 13, 2018

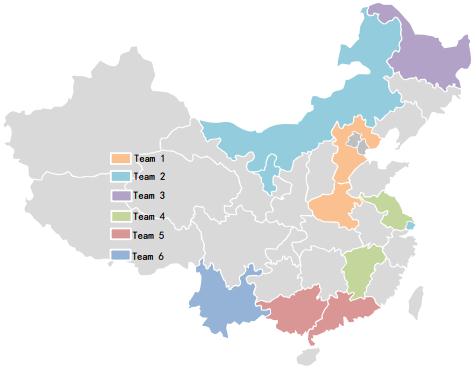

Shandong (JLC), July 13, 2018–In May 2018, according to the Ministry of Ecology and Environment, the first batch of central environmental protection inspection “look back” started. The inspection was composed of six central environmental protection inspection teams. From May 30th to June 7th, the six inspection teams stationed in Hebei, Inner Mongolia, Heilongjiang, Jiangsu, Jiangxi, Henan, Guangdong, Guangxi, Yunnan, Ningxia and other provinces for one-month inspection, which was the first “look back” since the central environmental protection inspection in 2015.

Currently, the one-month environmental inspection was coming to an end. For the feedback, the “look back” had significant impact on local industries. From the data released, up to end-June when the “look back” was completed, 1,056 enterprises were fined in Hebei, Ningxia, Heilongjiang and Jiangxi. In early July, inspection team in Guangxi handled and solved 18 batches of 149 key issues. During this period, various problems such as perfunctory and fake rectification in Henan, Yunan and Jiangsu were settled accordingly.

On June 7th, the Ministry of Ecology and Environment issued the 2018-2019 Strengthening Supervision Plan for Key Areas of the Blue Sky Defence, and the inspection started on June 11th.

The incentive supervision is from June 11th, 2018 to April 28th, 2019.

Supervision scope includes ”2+26” cities (Beijing, Tianjin, Hebei, and the surrounding areas), the 11 cities in Fen Wei Plain (Lvliang Shanxi, Jinzhong, Linfen, Yuncheng, Luoyang Henan, Sanmenxia, Xian Shaanxi, Xianyang, Baoji, Tongchuan, Weinan and Yangling), and Yangtze River Delta.

Supply:

Against this backdrop, the operating status of methanol units in methanolin Henan, Jiangsu, Shanxi and other regions were influenced. The 350,000 mt/yr methanol unit of Henan Zhongxin Chemical shut down on June 14th for one month maintenance due to environmental issues. During the period, some methanol

units in Jincheng, Shanxi were offline, including Shanxi Jinfeng Coal Chemical and Shanxi Tianze Coal Chemical. Some projects restarted and some units were put off from restarting.

Besides, the 600,000 mt/yr methanol unit of Shaanxi Coal and Chemical shut down for 15-day maintenance. Previously, a 300,000 mt/yr unit was offline due to environmental issues with restart date uncertain. The 600,000 mt/yr unit of Shaanxi Changqing Energy & Chemical cut loads to 50% on July 11th. The 600,000 mt/yr methanol unit of Gansu Huating Coal was offline temporally. From March 2018, coking gas-to-methanol projects in North Jiangsu were offline, and sources said that some projects’ restart might be put off further, including Jiangsu Weitian Chemical, Xuzhou Huayu Gas and Shandong Yizhou Energy, with total capacity at 750,000 mt/yr.

In addition to tight supply caused by environmental protection in the short term, July will witness methanol unit overhauls, which further boosts market prices. Market insiders should eye on the unit overhauls situation.

Demand:

Run rates of formaldehyde and DMF declined around mid-June. According to JLC’s data, the run rate of formaldehyde industry decreased to 30%, and that for DMF decreased to 51%. In addition to influences of rainy season factors, formaldehyde and plates enterprises’ demand for methanol declined amid the environmental protection inspection, especially in Guangdong and Guangxi. Thus, methanol market transactions were sparse in Guangxi.

In general, under the current trend of stricter environmental protection supervision, the technology and processes of various industries have been continuously upgraded, such as the continuous improvement of environmental protection facilities of coking industry in some regions. In the next few years, environmental protection factors’ influences on the elimination of backward capacity of methanol and downstream industries cannot be neglected, which will further promote the transformation and healthy development of the industries.