Methanol price trend overview & forecast, 2018

June 27, 2018

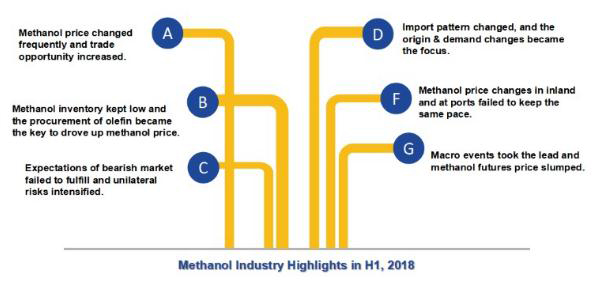

Shandong (JLC), June 27, 2018–China methanol market prices were volatile in H1, 2018. Price fluctuation period shortened from 3-4 weeks to 2-3 weeks, affected by product properties and transactions. Currently, trading opportunities in China methanol market increased obviously. For price, it went range-bound at low levels in Q1 and took a Mshape trend in Q2. Influencing factors include port inventories, methanol unit overhauls in Spring, natural gas restriction in Southwest China, and Sino-US trade war.

China methanol market prices went range-bound in H1, 2018 as a whole. In January, producers in main production areas cut offers to promote sales amid port closure, higher freight caused by the snowy weather, low port inventories, etc. In February, the market was weak during the Spring Festival and producers in main production area cut offers to promote transactions. In March, futures price trend took a reversed V-shape trend. Prices rose to the CNY 2,827/mt on March 22nd and then decreased. In March, main factors influencing the market were unit spring overhauls, port inventory cut and the normal methanol purchase of olefin plants. However, Trump announced to impose taxes on China-origin goods with a total value of $60 billion on June 23rd, followed by futures prices plunge of commodities.

Methanol price took a M-shape trend in Q2.

In H1 May, market prices rose to CNY 2,888/mt amid low port inventories, low import volume, centralized import goods, environmental protection inspection in North Jiangsu, and the methanol purchase from olefin plants in Northwest China.

Though some olefin units took maintenance during this period, the overall supply was tight, coupled with the paper goods delivery. Market supply-demand fundamentals were weak in H2 May. Market prices went range-bound in June. Futures prices surged on June 8th, which pushed up the spot methanol price on June 11th, coupled with low port inventory and low import volume. However, futures and spot prices declined after the Duanwu Festival amid plunged commodity futures caused by the Sino-US trade war, weak traditional downstream demand and the increase of port inventory.

For the supply in H1, 2018, the import volume totaled 3.25 million mt in January-May, up 50,000 mt YoY.

The import volume of H1, 2018 was expected to be 3.85 million mt. China methanol capacity expanded by 1.8 million mt/yr, including Xinneng Fenghuang (Tengzhou) Energy (200,000 mt/yr), Shandong Jinneng Technology (200,000 mt/yr), Anhui Haoyuan Chemical (800,000 mt/yr), and ENN Energy (600,000 mt/yr). US’s newly-added unit (1.75 million mt/yr) was commissioned in early June. Downstream demand was sluggish. In terms of profits, AA was the most profitable product. DME producers suffered profit loss in some periods. Formaldehyde production profits were around the zero axis. Olefin plants’ profits varied. For the profit of a port MTO unit purchasing feedstock from the market, it stood at CNY 132/mt in Q1 and at minus CNY 306/mt in Q2.

For the supply-demand fundamentals, main influencing factors in H2, 2018 are as follows. First, newly-added units will be commissioned. Units of Shanxi Jincheng Anthracite Mining Huayu (300,000 mt/yr) and Hengli Petrochemical (500,000 mt/yr) are planned to start up in Q3, which need to be eyed on. Commission date of Iran’s newly-added unit (2.3 million mt/yr) is uncertain, and its MAR165 unit was planned to start up in Q4. Market insiders should eye on newly-added units’ influences on import. Second, demand may improve. Although newly-added demand from the olefin plants is limited, market insiders should focus on the downstream units of Hengli Petrochemical (including MTBE, AA and hydrogenation) and Yanan Energy and Chemical. Third, market insiders should focus on the run rate change of traditional downstream units.